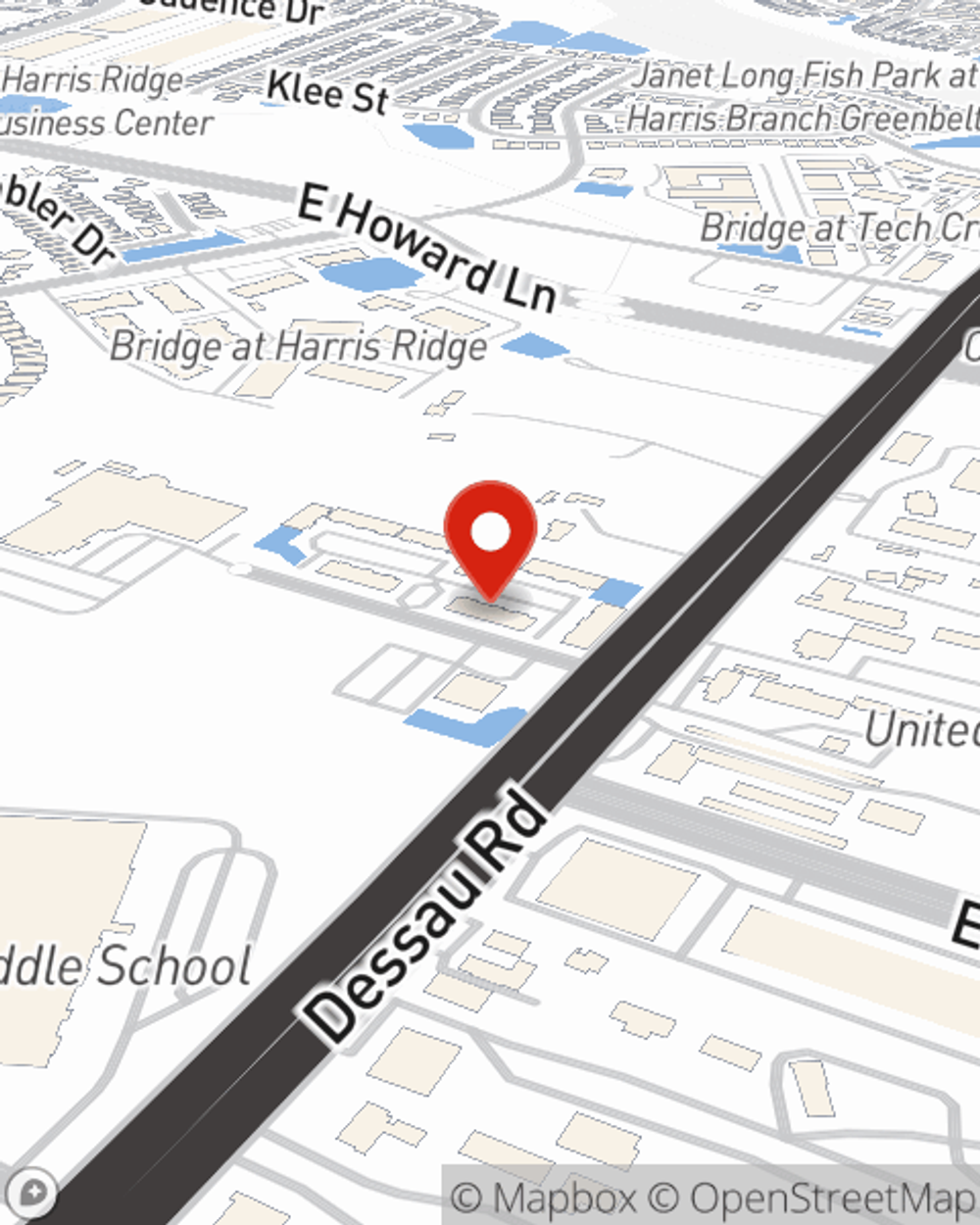

Business Insurance in and around Austin

Looking for small business insurance coverage?

No funny business here

- Austin

- Elgin

- Round Rock

- Georgetown

- Dallas

- San Antonio

- Houston

- Bastrop

- Pflugerville

- Manor

- Cedar Park

- Taylor

- Leander

Help Prepare Your Business For The Unexpected.

Do you own a photography business, a camping store or cosmetic store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Looking for small business insurance coverage?

No funny business here

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, commercial liability umbrella policies or surety and fidelity bonds.

As a small business owner as well, agent Robert Ndegwa understands that there is a lot on your plate. Call or email Robert Ndegwa today to chat about your options.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Robert Ndegwa

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.